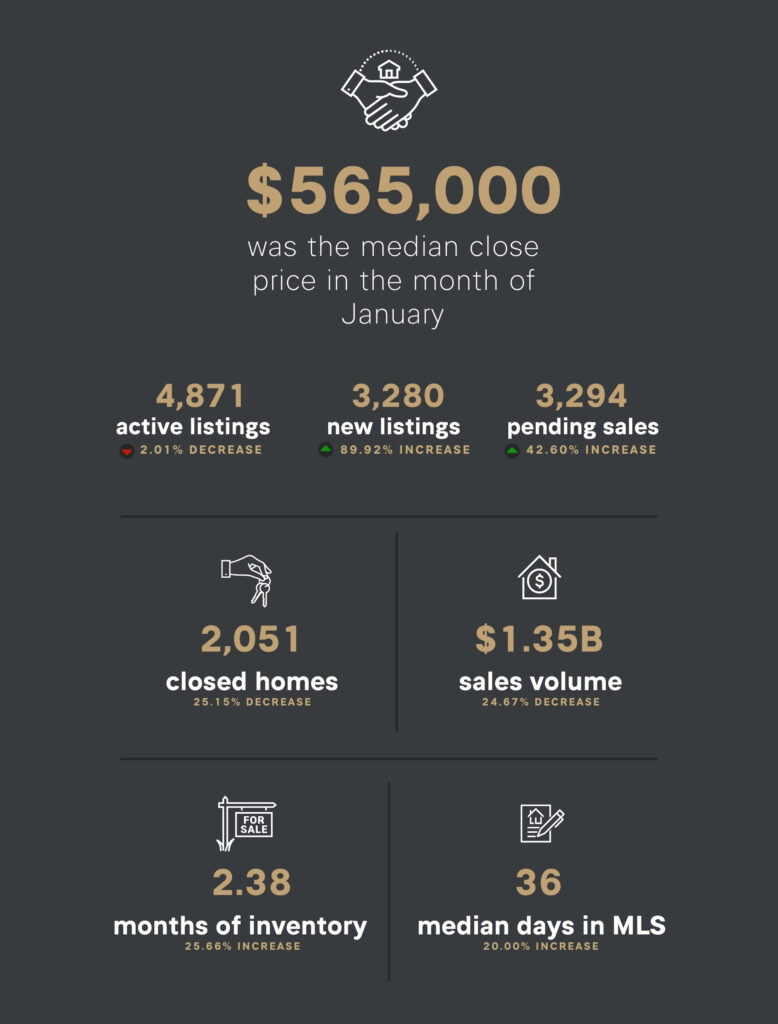

As we analyze the data from January for our February report, several notable trends emerge.

New Listings Surge: A standout observation is the influx of new listings. The market is witnessing a swift transition of these new listings into contracts, reflecting a robust demand. Despite the competitive landscape, the supply-demand balance favors sellers. Multiple offers are common, yet prices are generally maintaining proximity to the listing prices.

Persistent Impact of Rates: The influence of interest rates on our market is expected to endure throughout 2024. While interpreting the Federal Reserve’s recent meeting, it is evident that the consensus leans towards the conclusion of rate hikes. Although the Fed refrains from explicitly predicting rate drops, the prevailing sentiment suggests a potential shift. The Federal Reserves Governors’ prevailing belief points towards a high likelihood of a 0.75% rate decrease in 2024.

However, recent anomalies on 2/2 and 2/5 have raised eyebrows. Interest rates experienced a spike, triggered by a jobs report revealing a significantly larger uptick in hiring than anticipated. Actual job creation in the non-farm market amounted to 353k, surpassing the forecasted 180k.

Impact of Strong Labor Market: The correlation between a robust labor market and higher interest rates is apparent. Bond markets exhibited an unexpected drop earlier in the week, followed by what seems like a substantial rebound. The market displayed a reset throughout the week, oscillating within a range that aligns more closely with expectations.

Denver Market Implications: Amidst the rate volatility on 2/2 and 2/5, it is crucial to focus on the broader direction in which rates are moving. Despite the fluctuations, the Denver market exhibits pent-up demand, with pricing remaining relatively stable. As rates decline, careful attention should be paid to pricing dynamics. The current market scenario underscores strong demand, yet pricing remains tightly aligned with expectations. It is advisable to navigate the market with an awareness of the overarching rate trends rather than being swayed by short-term fluctuations.

February 2024 Denver Market Stats from DMAR

*Featured image: Graph Created with Bing AI 2.5.24 of prompt “financial arrows going up and down”