Denver Real Estate Market Insights: Wrapping Up 2024 and Looking Ahead to 2025

As the year comes to a close, the RealGroup team wishes you and your loved ones a happy holiday season! Reflecting on this year’s real estate trends, we’ve seen an interesting mix of challenges and opportunities, and the Denver market is no exception. Here’s a breakdown of what we’ve observed and what to expect moving forward.

2024 Market Overview

The fall decline brought a notable price drop in October, followed by a slight rebound in November, putting the market back on historical trends. Despite this recovery, activity remains slow. National sales volume is at its lowest point since 1995, even though the U.S. population has grown by over 60 million since then (source: NAR, U.S. Census).

What’s causing the slowdown?

- Low Inventory: With only three months of housing supply in Denver, the market technically remains a “seller’s market.”

- High Mortgage Rates: Today’s elevated rates discourage both buyers and sellers. Many homeowners are reluctant to sell because they locked in historically low rates, while buyers hesitate due to higher financing costs.

Why Are Prices Where They Are?

Housing prices have been driven upward by a combination of factors:

- Supply Shortages: Years of limited new construction created a deficit in available housing.

- Cheap Financing: Ultra-low interest rates from 2013 to 2020 made borrowing inexpensive, boosting demand.

- Pandemic Impact: Trillions in stimulus dollars created inflation levels unseen since the 1970s.

The Federal Reserve has worked to curb inflation by raising interest rates. While this has stabilized the Consumer Price Index (CPI) to a 2% slope, it has also significantly shifted affordability in the housing market.

What Needs to Change?

For the Denver real estate market to regain momentum, we need:

- Increased Inventory: A boost in supply would stabilize prices, coupled with lower rates.

- Lower Mortgage Rates: Rates in the mid-5% range would make buying a home more accessible for many.

For context, the average rent for a 3-bedroom, 2-bathroom home in Denver is $3,200/month (source: Zillow). If mortgage rates dropped from 6.75% to 5.5%, the monthly cost of purchasing a $650K home would align more closely with current rental prices, making ownership more appealing.

Optimism for 2025 and Beyond

The good news? The Federal Reserve has tamed inflation, and interest rates are starting to soften. Key indicators, such as the Consumer Price Index and Employment Stats, suggest we’re on the path to lower mortgage rates.

Advice for Sellers and Buyers

For Sellers:

If you’re planning to list your home this spring, now is the time to prepare. We can help you optimize your property for maximum value, leveraging our deep understanding of buyer preferences and market trends.

For Buyers:

Patience is key. While there are deals to be found, it’s crucial to work with a knowledgeable team that can help you identify true opportunities. Whether you’re relocating to Denver or upgrading your current home, our team is here to guide you.

Looking Ahead

As we move into 2025, we remain optimistic about the Denver real estate market. Lower rates and increasing inventory will bring more balance, and with it, new opportunities for both buyers and sellers.

Enjoy the holiday season, and let’s look forward to an exciting year ahead! Whether you’re relocating, buying, or selling in Denver, the RealGroup team is here to help you navigate every step of the process.

Contact us today to start planning your next move!

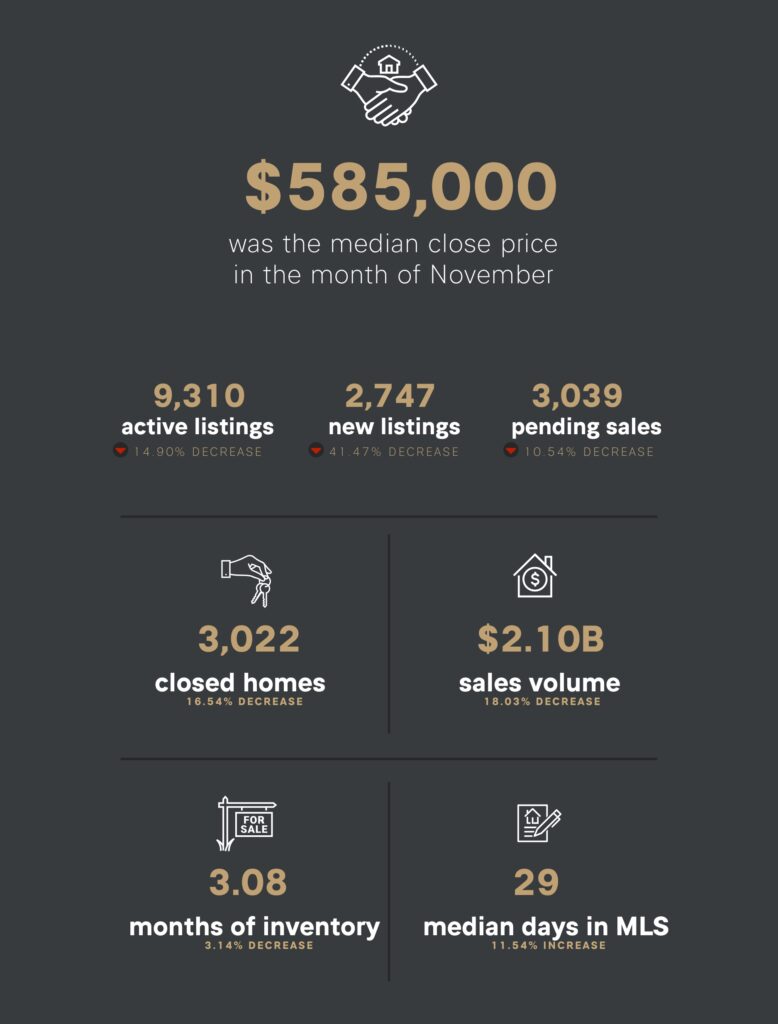

December 2024 Market Stats