Is Denver Experiencing a Housing Bubble?

If you’re keeping up with the Denver real estate market, you might be wondering: Is Denver currently experiencing a housing bubble? Looking at indicators like the Case Shiller Index or Zillow home value estimates, it’s a natural question to ask. Let’s break it down, starting with what defines a housing bubble.

A housing bubble is typically characterized by:

- Rapid and unsustainable price growth

- Excessive speculation and investment

- Loose lending practices

- Overbuilding

- Detachment from economic fundamentals

- Emotion-driven decisions (e.g., fear of missing out or FOMO)

Most of the U.S. experienced rapid home price growth over the past few years, but was it driven by a true detachment from economic fundamentals? Let’s explore the Denver market specifically.

COVID’s Impact on the Housing Market

COVID-19 introduced a wave of economic uncertainty and unusual market conditions. To stabilize the economy, we saw significant government stimulus, low interest rates, and supply chain constraints—all of which played a major role in shaping the housing market.

As a result, inflation surged. According to government data, inflation is up approximately 26% since 2019. Put simply, something that cost $1 in 2019 now costs $1.26. But how did housing align with this inflationary trend?

In 2019, Denver’s median home price was around $420k. By the end of 2024, that number climbed to $580k—a 38% increase. This is where the housing bubble debate begins:

- Is a 38% rise in home prices justified compared to a 26% increase in inflation?

- Does this 12% gap indicate a bubble?

Appreciation vs. Inflation: Is Denver Really in a Bubble?

It’s easy to look at the numbers and assume Denver is experiencing a housing bubble. However, let’s add some context:

- Historically, Denver homes appreciate at a rate of 5–8% annually.

- During this “bubble” period, Denver homes appreciated at an annualized rate of 6.7%, which falls within the historical range.

- Inflation also rose at an annualized rate of 3.9% during this time, higher than the historical average of 2.3%.

When you account for inflation, Denver’s annual appreciation aligns closely with its historical norms. The additional appreciation we saw in 2022 can be attributed to a rush to lock in low mortgage rates, not irrational speculation.

Why 2022 Felt Like a Bubble

In 2022, Denver home prices peaked roughly 3% higher than where they are today. Why? Buyers were eager to lock in historically low mortgage rates before they skyrocketed.

Consider this example:

- A $1M mortgage at 4.75% interest (common in early 2022) saves over $365k in interest payments compared to a 6.75% rate (common later that year).

- This translates to a monthly savings of roughly $1,015/mo on financing costs.

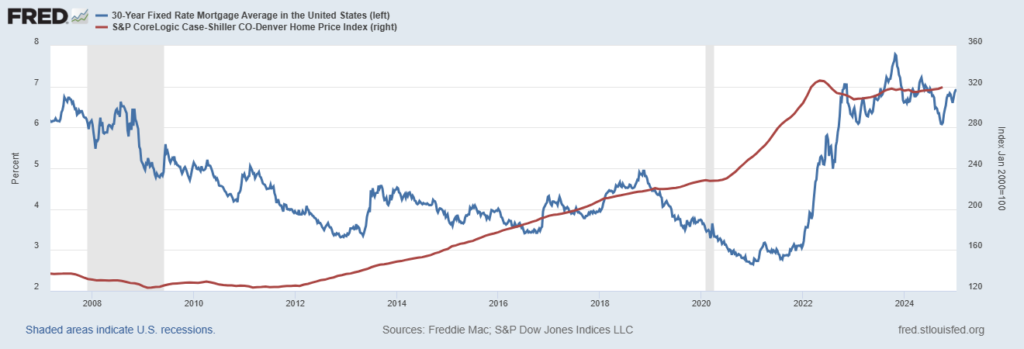

Paying a 3% premium to secure these savings doesn’t scream “bubble”; it reflects rational financial behavior under market conditions at the time. The chart below, featuring the Denver Home Price Index, illustrates the rise in home prices (red line), which began just slightly before mortgage rates started to increase (blue line).

Source: Federal Reserve Bank of St. Louis, FRED, 30-Year Fixed Rate Mortgage Average in the United States and S&P CoreLogic Case-Shiller CO-Denver Home Price Index, retrieved from https://fred.stlouisfed.org/series/MORTGAGE30US# on January 14, 2025

What’s Happening in the Denver Market Now?

Currently, both supply and demand in the Denver housing market are depressed:

- Builders face high costs for labor and materials, making it difficult to lower prices.

- Many homeowners with low-rate mortgages are staying put, further tightening inventory.

This lack of activity creates greater volatility in pricing. Automated valuation models, like those used by Zillow, often fail to account for factors like mortgage rate sensitivity, leading to inconsistent estimates. For example, two nearly identical homes might sell for $25,000 apart simply because of differences in financing terms for a given week. No two houses are alike either, and AI can’t replicate a human feeling about a given

So, if your automated home estimate is down, don’t panic—it doesn’t necessarily mean Denver is in a bubble. Contact us for a better estimate!

What’s Next for Denver Real Estate?

We expect the Denver market to experience sideways movement for a while, as broader economic and political uncertainties settle. Over time, the bond market will stabilize, inflation will become more predictable, and the credit spread on mortgage rates will narrow.

In the meantime, patience is key. While it might not feel reassuring to hear that the market is behaving as expected, the numbers tell a clear story: Denver’s housing market has been more aligned with inflation than many realize.

Need Guidance? Let Us Help

Navigating Denver’s real estate market—whether you’re buying, selling, or relocating—can feel overwhelming. But as dedicated Denver Realtors, we’ve got your back.

We run the numbers, analyze the trends, and help our clients make informed decisions, whether that’s finding the perfect home, maximizing your home’s resale value, or making a move to the Mile High City.

Let’s chat about your real estate goals and create a plan that works for you. Contact us today!

Denver’s housing market isn’t in a bubble—it’s in transition. Let us guide you through it with clarity and confidence.

*Featured Image – Generated with CoPilot AI ∙ January 16, 2025 at 8:59 AM