The outlook for the real estate market in 2024 is shaping up positively. We witnessed a welcomed Christmas surge in the stock market, largely influenced by predictions of the Federal Reserve implementing rate cuts this year. Early inflation data and the overall trend indicate a gradual reduction in inflation, an essential concept to grasp.

It’s crucial to distinguish between deflation and disinflation. While deflation is a decline in prices, disinflation refers to the slowing of inflation. Currently, we’re experiencing positive growth in inflation, an economic healthy sign.

The debate lies in our natural inclination for wanting things to become more affordable. However, a continuous drop in prices could be detrimental to the economy. Waiting for lower prices might seem intuitive, but it could lead to a contraction in consumer spending, impacting businesses, jobs, and stalling economic growth—a scenario witnessed during Japan’s lost decade.

The goal is moderate inflation, ideally below 3%, where the impact is more subtle. In recent times, inflation above 3% has been noticeably impactful, exemplified by the 30% increase in the price of Arizona Ice Tea. This inflation impact guides the Federal Reserve in setting rates to stabilize prices across industries.

Setting higher rates raises the cost of goods, curbing spending, and reducing inflation. However, this strategy has a delayed effect, taking almost two years to be felt in the economy. We’re currently approaching the end of a two-year rate hike cycle, and there’s concern about whether the Fed may have raised rates too high, risking a recession—the elusive soft landing.

The Fed faces a delicate balancing act. Maintaining high rates risks a recession, while easing off too soon could result in persistent high inflation. They’re navigating this challenge based on historical data trends, and there’s an expectation of lowering rates as inflation data declines.

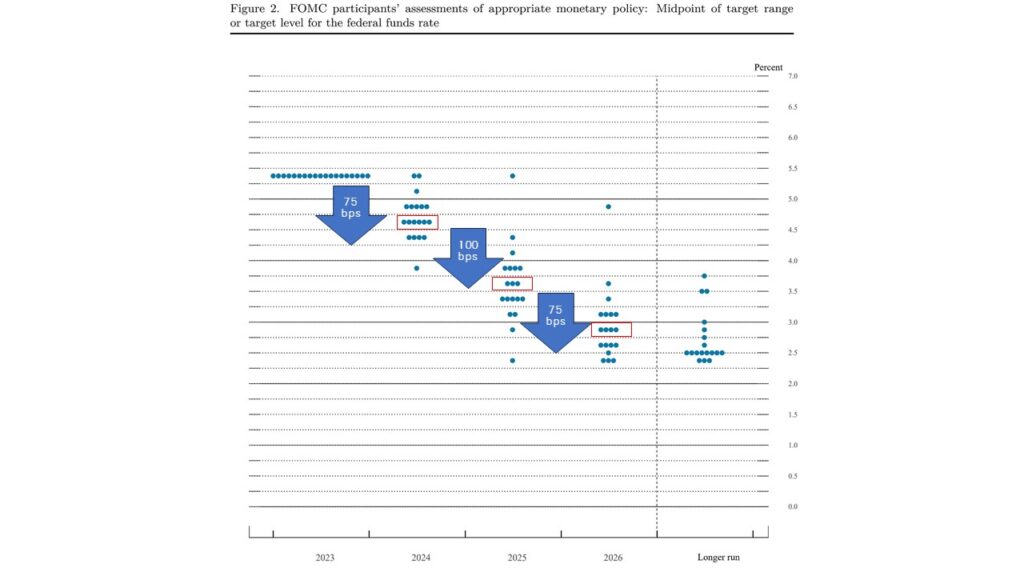

The dot plot below illustrates the various perspectives of Fed participants on rate movements, reflecting the complexity of forecasting in this economic landscape.

Source: US Federal Reserve Summary of Economic Projections, December 13, 2023

The majority of the Federal Reserve anticipates a substantial 75 basis point reduction by the close of 2024—a favorable development for the housing industry. The decline in financing costs and future projections is contributing to a reduction in our credit spread. This reflects the perception that lending money is less risky, prompting banks to lower the margins they add when lending to you. In essence, these factors collectively point towards lower interest rates. The arrows in the above graph have been added to approximate where the majority sees rates and the associated basis point reduction.

While the Federal Reserve may exercise caution in declaring victory over inflation, we can anticipate a gradual movement in rates. However, credit spreads are expected to be narrower compared to 2023. A significant observation in the real estate market is the stabilization of pricing. Individuals who secured ultra-low rates are less inclined to move, constraining supply and stabilizing housing prices. Coupled with the increased costs associated with constructing new homes due to general inflation, a further decline in prices is not anticipated. This marks the establishment of a new normal in the real estate landscape. And I will continue to grumble about why things cost more….