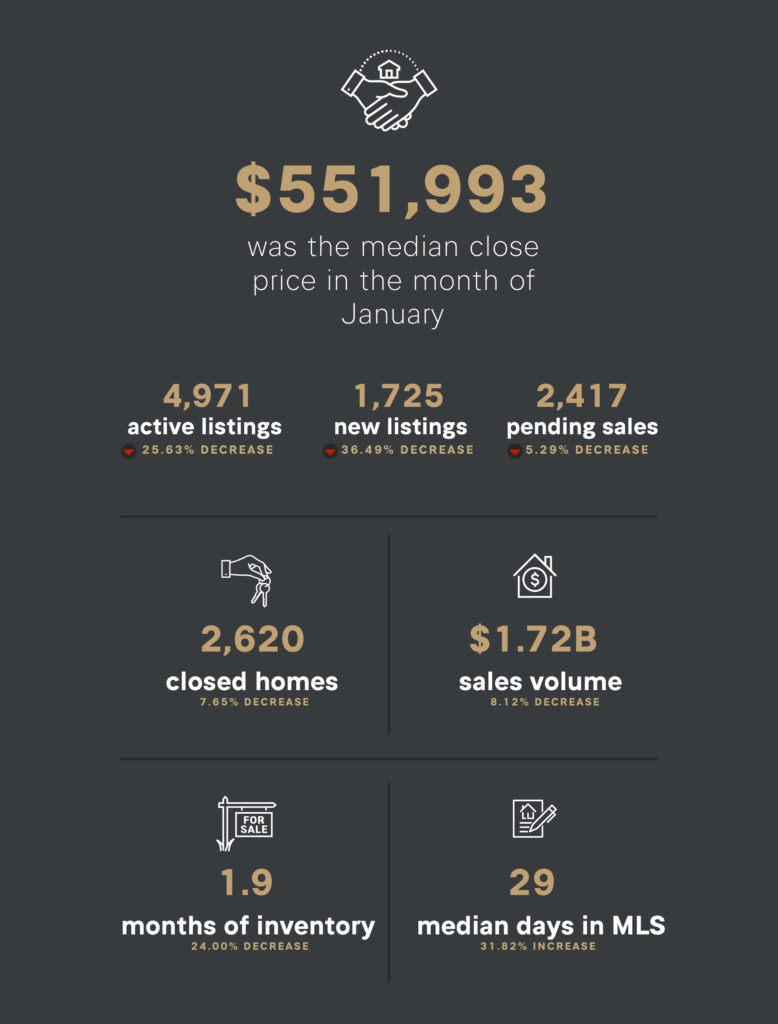

Our December 2023 statistics revealed a persistently sluggish market with minimal listings, transactions, and a continued stall during the holiday season. January reports confirmed our expectations, depicting an annual average appreciation of 3.3%. However, there was a 6.3% decrease in overall sales volume and a 9.3% decline in the number of closings. In contrast, the average days on market slightly increased to 6.9%. The market experienced a tightening effect throughout 2023.

The outcomes of 2023 present a hopeful signal for 2024. The market’s constrained volumes were influenced by sellers hesitating, possibly opting to retain their low-interest rates rather than making a move. This contributed to the stabilization of housing markets nationwide, evident in Case Schiller’s data illustrating relatively flat year-over-year home values. It suggests that some of the excess liquidity from Covid stimulus and low rates is gradually dissipating.

Entering 2024, optimistic indications are emerging. The easing of rate pressure suggests a healthier real estate market. Although the environment is expected to stay relatively subdued, an uptick in inventory is anticipated with the onset of the spring season. Vigilance will be maintained on price trends to assess whether they are gradually factoring in anticipated rate drops, a pivotal factor influencing potential appreciation.