Market Trends and Opportunities: A Mid-Year Real Estate Update

As we dive into the latest set of market data, it’s clear that our team’s predictions from last month are coming to fruition. The anticipated trends of increased listings and longer selling times are indeed taking hold. Interestingly, this shift is not confined to the luxury market alone; it’s trickling down to lower-priced listings as well.

Surge in Listings: What’s Driving It?

One of the most notable changes is the significant surge in listings. While pinpointing the exact cause is challenging, the data shows a dramatic increase in inventory. One theory is the decline of the “accidental landlord.” This term refers to homeowners who, post-COVID, took advantage of low interest rates to buy new properties while retaining their old homes as investment properties due to their low carry costs. A pivotal factor for these accidental landlords could be the IRS rules on capital gains taxes. Sellers can avoid up to $250,000 or $500,000 in capital gains tax, depending on their filing status, if they have lived in the property for at least two out of the last five years. As we approach the end of this period, it’s possible that many of these landlords are deciding to list their properties to take advantage of these tax benefits.

Implications for Sellers and Buyers

For sellers, this influx of inventory is not necessarily good news. With more homes on the market and demand slowing, competitive pricing becomes more crucial than ever. On the flip side, this is excellent news for buyers. While bidding wars haven’t disappeared entirely, the intense pressure seen in the past few years has eased, making it a great time for new buyers to enter the market. The stabilization of prices is a healthy sign, particularly as we observe the typical seasonal flattening of the spring market.

Looking Ahead: Economic Indicators and Market Predictions

So, what’s next for the market? Our attention is firmly on key economic indicators like the Consumer Price Index (CPI) reports, job reports, and credit markets. The Federal Reserve is closely monitoring these factors to determine when market demand has sufficiently cooled to achieve its 2% inflation target. Relief on interest rates will come once this goal is in sight, likely sparking a market reaction. The stock market surge on cooler inflation data can be a key indicator; however, note that in these rate transition periods there is excess volatility.

Seizing the Opportunity

This period of market adjustment might just be the perfect opportunity for savvy buyers. As I often remind my clients, Warren Buffet advises buying when others are fearful. This contrarian approach can be challenging, but it often leads to the best long-term gains.

Conclusion

The current real estate market offers a mix of challenges and opportunities. Sellers need to be strategic with their pricing, while buyers can benefit from reduced competition and more stable prices. As always, staying informed and ready to act will be key to navigating these changes successfully. Feel free to reach out if you have any questions or need guidance. We’re here to help you make the most of these market dynamics.

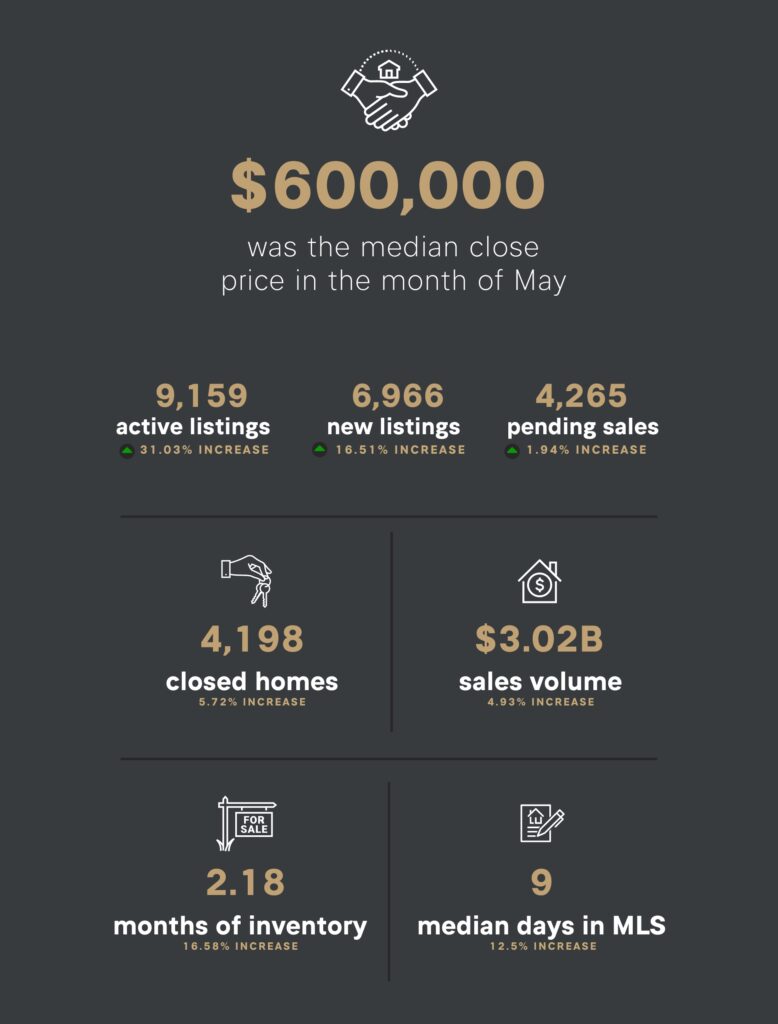

June 24 Denver Market Stats