Denver Housing Market Outlook 2026

What Buyers, Sellers, and Relocations Should Actually Take Away

Welcome to 2026.

Every January brings the same question from buyers, sellers, and people relocating to Denver:

“So… what’s the market doing now?”

The honest answer?

2025 was a very “meh” year.

Prices moved up, then down, then sideways. Headlines were loud, but the data was quiet. To ground things in reality, we compared January 2025 vs. January 2026 market stats (released with a one-month lag, so these are effectively year-end snapshots).

Median Price: Flat, Not Falling

Yes, the median price dipped slightly year over year. Cue the dramatic headlines.

In reality, prices were down 0.86% YoY. That’s not a correction. That’s normal market variability.

What actually happened in 2025 was a shift in what sold, not a collapse in values. More lower-priced homes closed, pulling the median down, while most individual homes held their value. This distinction matters, and it’s why price indices like Case-Shiller stayed essentially flat.

Inventory: Up, But Not a Flood

Inventory is the more noticeable change heading into 2026.

- Inventory increased roughly 9% year over year

- Months of inventory moved from 2.22 → 2.45

- Still firmly a low-supply market by historical standards

Translation: buyers have more choice, but not leverage the way they did in true buyer markets.

Denver JAN 2025 Market Stats Table

Why Prices Didn’t Drop With Higher Inventory

This is the key question we keep getting.

Historically, meaningful price declines require:

- A sharp spike in inventory and

- A collapse in demand

We only got one of those.

Inventory rose modestly, but:

- Demand remained stable

- Mortgage rates cooled late in the year

- Sellers didn’t panic

As a result, prices didn’t reprice downward to “match” inventory. Instead, the market absorbed it.

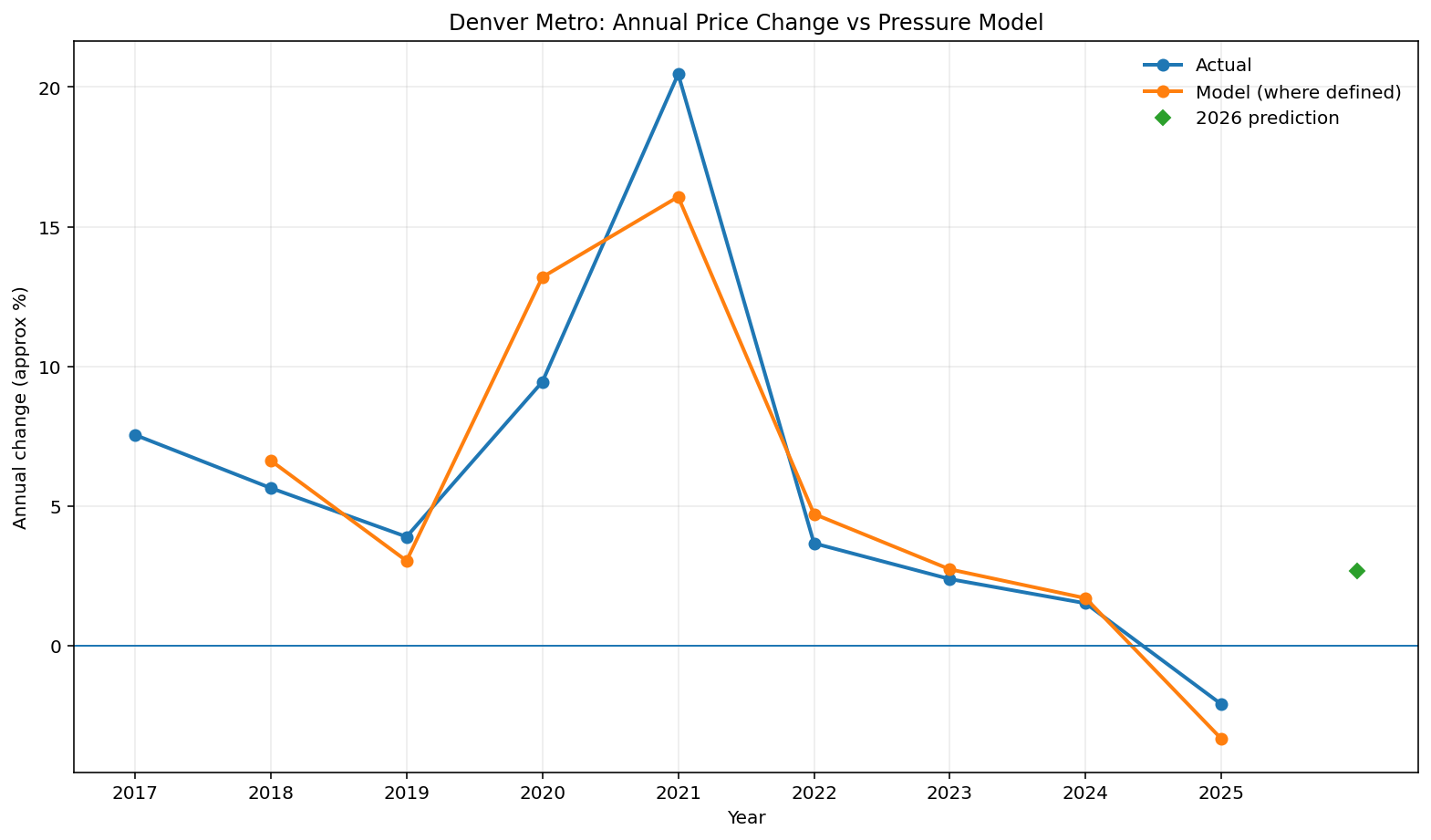

Denver Home Price Forecast for 2026 (Simplified)

Using 2025 as a lagging input, our pricing model points to modest appreciation, not a surge and not a drop.

What the model is saying, in plain English:

- Expected 2026 price growth: ~2.7%

- Most likely range: roughly flat to low-single-digit growth

- Baseline median starting 2026: ~$575,000

- Expected year-end median: just under $590,000

This aligns with what the line chart shows:

Flat growth since 2022, normalization back to long-term Denver trends, and mild forward momentum, not a boom.

Are models perfect? Absolutely not.

But directionally, this matches what we’re seeing on the ground.

Big Picture Context

Looking at year-end Case-Shiller, Denver has been essentially flat since 2022. That’s not a failure of the market, that’s a reset.

After overshooting during the ultra-low-rate years, prices paused long enough for fundamentals to catch up. Wage growth, household formation, and rent growth have all been doing the quiet work in the background.

The result?

Denver is back on its 50-year appreciation trend, not above it.

What This Means for Sellers in 2026

If you’re thinking about selling, spring still matters.

Inventory may be higher, but:

- The best homes still sell first

- Quality, location, and condition matter more than ever

- Buyers are price-sensitive, not absent

Well-prepared homes are still moving quickly and commanding strong prices. The days of “throw it on the MLS and see what happens” are gone, but smart pricing and presentation still win.

What This Means for Buyers

Buyers finally have options, but not discounts across the board.

- Better inventory quality often comes with higher prices

- Well-located, move-in-ready homes remain competitive

- The value plays are in patience, negotiation, and knowing which homes to pursue

This is no longer about rushing. It’s about choosing well.

A Note for Relocations: Why “Rent Before You Buy” Still Wins

For anyone relocating to Denver, this environment actually favors a rent-before-you-buy strategy.

With prices stable and inventory improving:

- You’re not missing runaway appreciation

- You gain time to learn neighborhoods

- You avoid overpaying for the wrong location

This is exactly why our RealGroup relocation model works. Flexible rentals give you stability, while allowing you to buy when the right home—not just a home—comes along.

Bottom Line

Denver didn’t crash.

It didn’t boom.

It normalized.

And normalization is healthy.

For buyers, sellers, and relocations alike, 2026 looks less dramatic and more predictable. And frankly, that’s exactly what a sustainable housing market should feel like.

If you want help navigating it—with data, strategy, and a clear plan—we’re here.