We were having some great conversations with our clients recently, and the topic of mortgages came up. Mortgages are paramount to your real estate success, so we thought it might be worthwhile to drop a post about mortgages. Our first post is to explain how a mortgage broker makes money. If you take anything from this post, know that a mortgage broker will typically make 1-1.5% on the loan amount ($500k loan = $5k for originating the loan). How you see this cost show up as your expense will vary, and we will do our best to explain the various ways you see these costs.

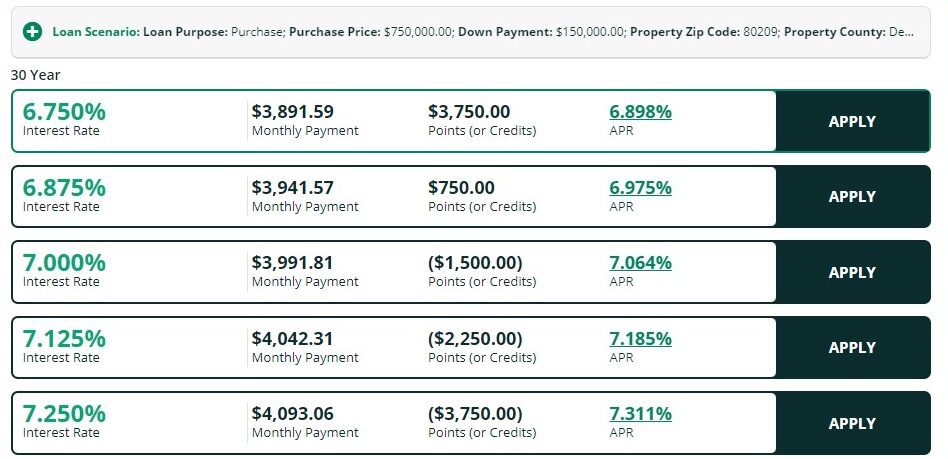

Points: A mortgage point, or just point, is equal to 1% of the loan. Points are the building block of how interest rates are packaged and sold. Points are used as a way to “buy down” the interest rate, thereby reducing the borrower’s monthly mortgage payments over the life of the loan. If you want to lower your rate you can “buy down” the rate by paying points. Each point you pay will lower the rate by usually 0.25%. For example, if a borrower has a $500,000 mortgage and decides to buy one point (equal to 1% of $500,000, or $5,000), they might lower their interest rate from 6.5% to 6.25%. The inverse of this is also true, if you need funds to close your loan it is possible to take a credit by taking a higher rate. In this instance you are selling points back to the bank.

Rate Sheet sourced using denoted loan scenario from: https://www.provident.com/QuickRatesCalculator on February 23rd, 2024.

Origination Fee: This fee is straight forward, and easy for you (the consumer) to spot. When you secure a mortgage through a broker, the lender/investor/bank (whoever has the money to lend) typically pays them a commission called the origination fee. It’s a percentage of the total loan amount and serves as compensation for bringing in the business. This is not always the total “fee” that you pay on your loan, it is just the easiest to spot. Paying a higher origination fee and a lower yield spread premium can offer greater transparency in understanding the costs associated with your mortgage

Yield Spread Premium (YSP): Think of the YSP as the broker’s bonus. Brokers may also receive a Yield Spread Premium (YSP) from the lender. It’s like a rebate or extra commission paid for originating a loan with an interest rate higher than what you qualify for. The broker can pass this premium to you to cover closing costs or keep it as extra income. They are selling a higher rate in exchange for a credit, think selling points to collect a credit. A broker has a rate sheet that outlines their cost of lending and the associated costs to change the rate up or down; to lower the rate requires money to paid upfront, whereas a higher rate results in a credit. This credit can be pocketed to the broker for selling you a higher rate. In our sample rate sheet above, this is what you, the consumer, would be offered as a way to take a higher or lower rate.

To know what Yield Spread Premium (YSP) a broker receives, just ask them. They’re required by law to disclose this information. You can also find it in your loan documents—the loan estimate and closing disclosure. And remember, if you’re unsure about any fees, don’t hesitate to ask for clarification. Understanding the terms and costs is key before diving into a mortgage.

Service Fees: On top of lender commissions, brokers might charge service fees. These vary depending on the broker and the services they provide, but they’re typically for helping you find and secure the right loan. These are the most transparent and easiest to understand on your loan fee worksheets. There are pieces that you can shop around for a better rate, and some that you are just stuck with. Sum up these service fees to easily compare the totals between mortgage brokers.

Now that you are armed with all of this great information, what do you do? How do you negotiate the best rate?

- Understand the terms- Understanding mortgage broker terms can be overwhelming, but don’t let that intimidate you. Take notes during discussions and don’t hesitate to ask questions. Remember, it’s your mortgage, and you’re in charge!

- Search rates online-When searching for rates, check out Provident for competitive rates advertised online.

- Mortgage calculators – utilize mortgage calculators like ours or create your own in Excel to really understand the inputs to a loan

- Mortgage brokers – When working with mortgage brokers, aim to compare rates from at least two, but no more than three. Beyond three quotes, there may be a credit impact due to a “hard pull” on your credit history. Brokers can often provide unofficial estimates based on your provided information.

- Ask for detailed loan estimate worksheets

- Compare the offered rate vs. the APR. For conventional loans, we want these numbers to be fairly close to each other.

- Ask them to tell you their YSP and to see a rate sheet. They may push back, that is ok!

- Sum all of the Service Fees for each broker to compare all the associated costs

- Compare the costs between mortgage brokers and make them compete for your business

You are now ready to take charge of your mortgage! And if you need help, a realgroup team member is just a phone call away!

*featured image created from Copilot AI using prompt “create image of mortgage interest rate sheet around 6%”