Why waiting on the Fed might be the wrong move

Everyone keeps saying the same thing:

“I’m waiting for the Fed to cut rates.”

It sounds smart. It feels safe. And it’s only half right.

If you’re buying in 2026, mortgage rates are not doing what headlines say they should. To understand why, you don’t need a PhD. You just need to stop watching the wrong thing.

First, the misconception

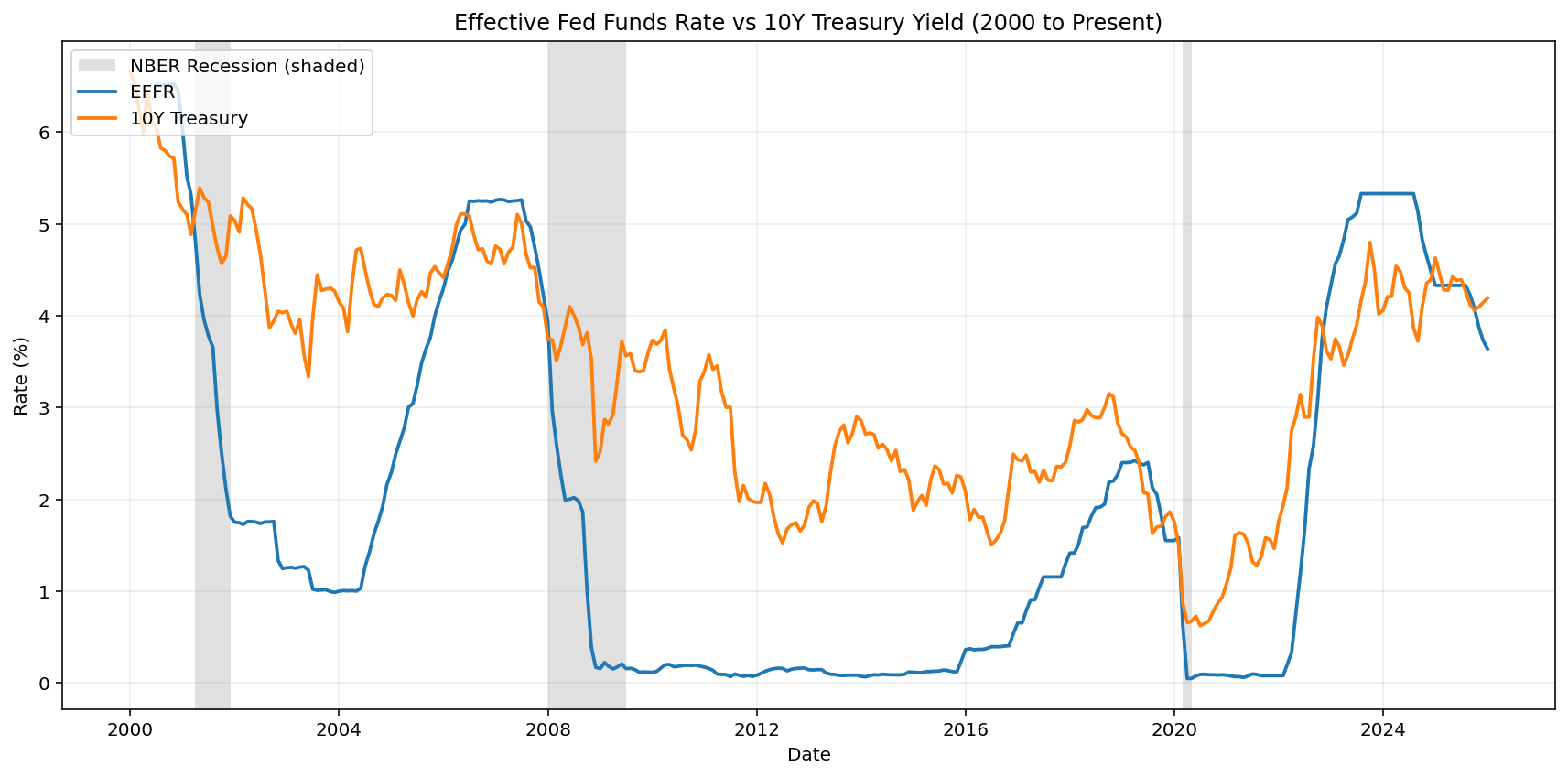

The Fed controls one thing directly: short-term overnight rates.

Mortgage rates are not short-term. And they are definitely not set by the Fed.

That’s where most of the confusion starts.

What actually moves mortgage rates

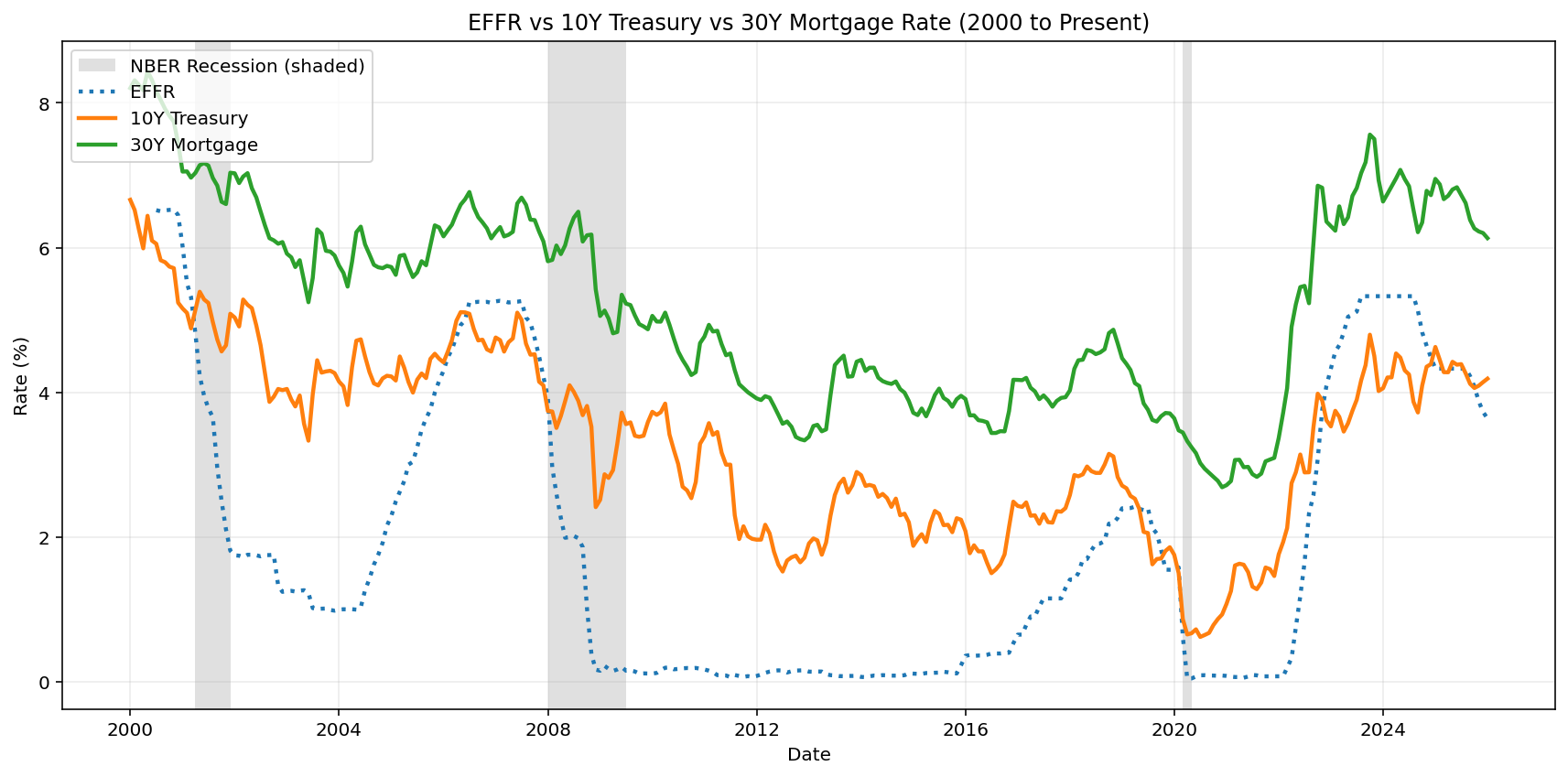

Over time, mortgage rates tend to follow longer-term bond yields, especially the 10-year Treasury. That’s why you’ll hear people say, “mortgages track the 10-year.”

Usually true. But “usually” is doing a lot of work there.

There are long stretches where mortgage rates drift away from Treasuries and behave differently. When that happens, it’s not about Fed speeches or press conferences. It’s about what’s happening inside the mortgage market itself.

The part no one talks about

Mortgage rates are built on top of mortgage-backed securities. Those come with quirks Treasuries don’t have.

When rates fall, homeowners refinance. Investors get their money back early.

When rates rise, refinances stop. Investors are stuck longer.

That uncertainty makes mortgage pricing sensitive to things like:

- market volatility

- liquidity

- investor demand

- lender competition

Not just interest rates.

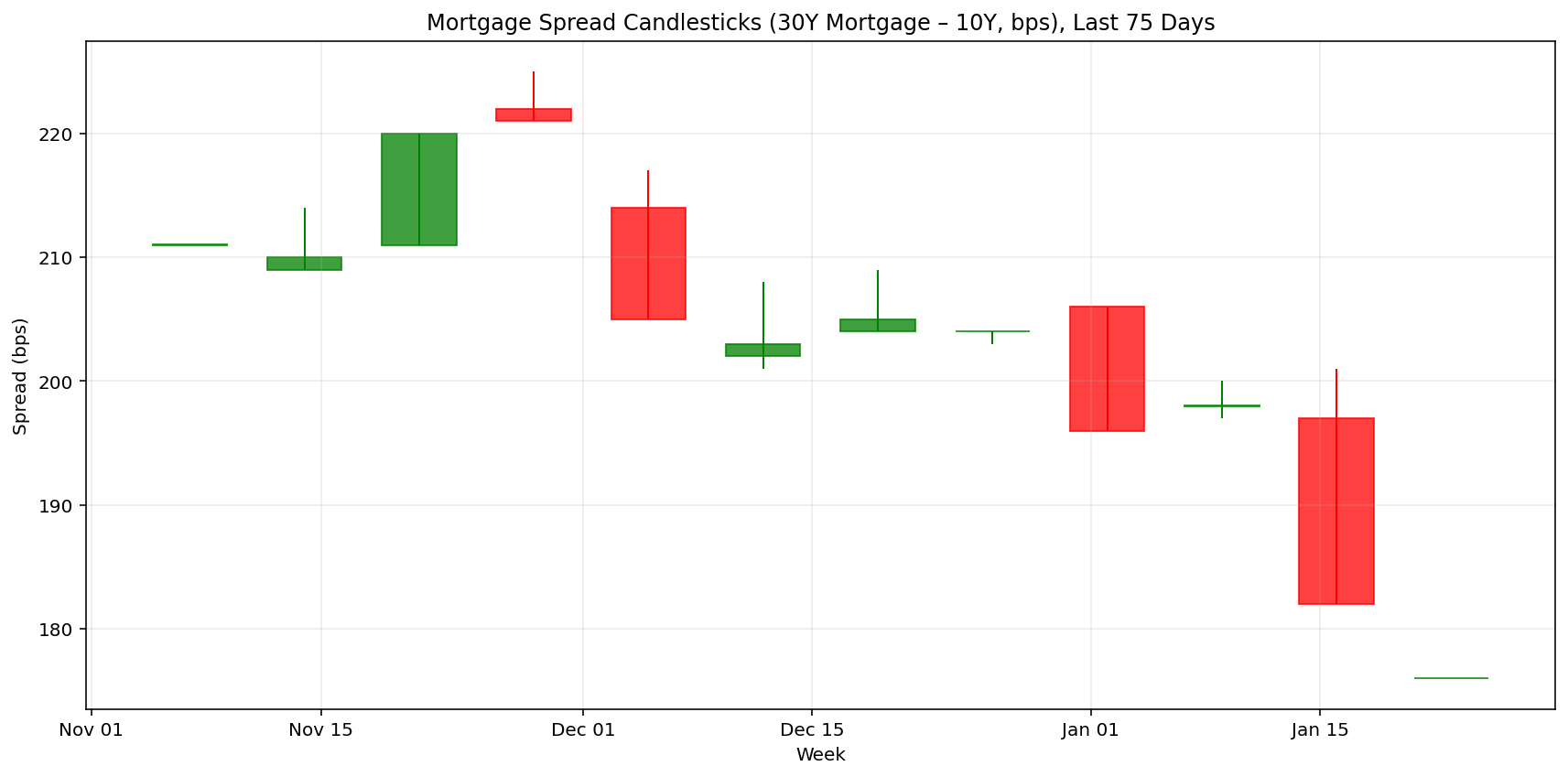

The result is something called the mortgage spread. In plain English:

how much extra yield investors demand to hold mortgages instead of Treasuries.

Why this matters right now

Here’s the key idea for 2026:

Mortgage rates can fall even if Treasury yields don’t, as long as that spread tightens.

And that’s exactly what we’re seeing.

If you’re waiting for the Fed to cut before expecting lower mortgage rates, you may already be late. Markets tend to move first. Mortgage spreads move on their own schedule.

So… should buyers ignore the Fed?

No. But they shouldn’t worship it either.

Fed cuts matter because they often reduce volatility. Lower volatility helps mortgage spreads tighten. That helps rates.

But the day-to-day reality is this:

Mortgage rates move more on spreads than on Fed decisions.

The better question to ask in 2026

Not:

“When will the Fed cut?”

But:

“Are mortgage spreads tightening or widening?”

That question actually explains what buyers are experiencing.

Why this matters for real people

Most buyers are told to wait for the Fed. Almost no one explains what actually drives mortgage rates on the margin.

At RealGroup, we care less about headlines and more about mechanics. Spreads, volatility, and timing tradeoffs matter. That’s why we build tools that show how small changes in rates and pricing can compound into real outcomes.

If you want to see how we think through those tradeoffs in practice, this ROI calculator breaks it down clearly:

https://realgroupdenver.com/how-does-a-60-roi-sound/

In markets like 2026, clarity beats prediction every time.

Chart One: EFFR is the Effective Federal Funds Rate.

It is the overnight rate the Fed targets and influences most directly. That is not the same thing as bond yields. And it is definitely not the same thing as mortgage rates.

Chart Two: EFFR vs 10Y Treasury

Chart 3: EFFR vs 2Y vs 10Y